Not so long ago ‘keeping the books’ for a business meant a completely paper-based process that involved a ledger and pencil recording your businesses financial data. In the digital age, however, it encompasses so much more than tallies in a book – especially when it comes to the ins-and-outs of the Accounts Payable (or AP) process.

But do you know just how much of your work could be automated with programs like Document Scanning or ‘Capture’ Software and Document Management Software, (or DMS)? Let’s take a look at just how much of your day-to-day could benefit from these types of paperless accounts payable software solutions.

Where do I start?

To understand the impact automation software can have for your AP department you must first understand what they deal with each day.

If they have no automation software, the paper process for the AP department likely includes mailing your purchase order to a vendor, waiting for the invoice to come, then cutting a check which was sent again via mail once goods had arrived.

Lots of hands moved these documents from one place to the next – not to mention any steps in between where

Document Scanning/Capture Software

Document Management Software

company internal policies had their part in a complicated dance of approval processing and more. Even if your business has an accounting software, it’s still likely that much of your accounts payable process is like the above and could benefit from implementing software solutions like document capture and document management software. Let’s look at each one, since they each offer a piece of the puzzle that is ‘accounts payable automation’.

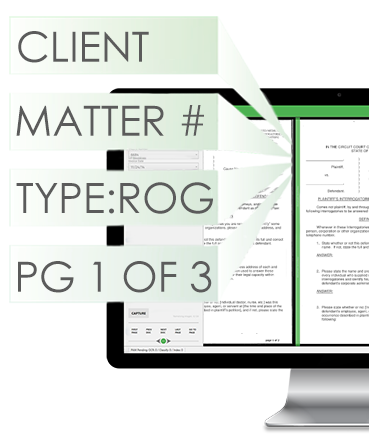

Document Indexing or 'Capture' Software

The first piece to this automation-puzzle is Document Scanning or ‘Capture’ Software. Why? Because this is when you turn those paper documents into electronic ones to get the whole process started. In fact, of all the accounts payable automation solutions you can choose from, this one saves your AP department the most amount of time even when you already have an accounting software, like QuickBooks, in place.

Capture Software lays the foundation for a true automated AP process by both classifying and then indexing documents, then working hand-in-hand with a document management system and your accounting software to streamline document and office workflows. Truly ‘smart’ or fully-automatic solutions in this category mean that your team scans in their paper documents and has nothing else to do until this data hits their queue in your Document Management System or accounting software.

What’s ‘Classifying’?

Classifying is the process of automatically identifying document types like invoices, purchase orders, packing slips, checks, purchase requisition forms, bills of lading, receipts, and even business-specific documents.

So, essentially, this is when the software determines, intelligently, what type of document it’s looking at – even determining the difference between vendors and supporting documents – before deciding what happens next.

What’s ‘Indexing’?

Once the software knows what type of document it’s looking at, it’ll index it and create a kind of roadmap that will help you search for information later.

Identifying information like invoice numbers, dates, GL codes, purchase order numbers, line items, vendor names, dollar amounts, etc. means that your staff no longer has to manually enter this type of information.

This info is sometimes entered more than once depending on your current office workflow which means you’re saving your staff a massive amount of time by not having to do all that tedious data-entry.

Some solutions in this category recognize types of documents and index data based on user inputs during the capture process, which might not save much time in the end, but it certainly helps in turning your paper-based process into a paperless one.

Other ‘smart’ solutions recognize types of documents and index data with little to no input from users at all, which alone, can be a massive time savings for your AP department. While this solution alone could easily integrate directly into your current accounting software solution, the next area we’re going to touch on is an important piece to the automation puzzle too.

How does Ademero measure up?

CapturePoint automatically recognizes your documents and can tell the difference between an invoice for accounts payable, a proposal submitted by one of your vendors, or even a group of related documents and then sort, process, and route them intelligently without human interaction.

Document Management Software

When you choose to use a document management software, all the information extracted from the document is then transferred during export to your DMS where it can then be used to further automate AP processes like approval workflows, purchase order and invoice creation, e-mail notifications, reporting, and more.

Truly taking your accounts payable department paperless means moving paper-based daily activities and office workflows to electronic ones. Let’s run through a few examples specific to accounts payable to show you just how helpful document management can be.

1. Approval Processing

Workflows act as a kind of controller within the software – recognizing key data and determining next steps. Approval Processing is the movement from point A to point B via the act of approval.

An obvious benefit of an electronic approval process is that the software handles all the routing, deadlines, notifications, tracking, and post-approval actions while your office staff simply approves or rejects items as they appear in their queue.

Ultimately, the process for a simple invoice approval ends up looking something like this:

An Invoice is Scanned at a multifunction device and picked up by Capture Software

Capture Software classifies, indexes, and exports electronic document and corresponding metadata to DMS

DMS routes invoice per approval process where Manager approves by clicking ‘approve’

Approved invoice and metadata is then sent to destination (ie: QuickBooks) for payment to be processed

In the simple and common example above, the only steps where human interaction was necessary was in 1) physically scanning the document and then 2) one click to approve from user’s queue.

Even routing documents through more than one user or an approval group is made exponentially easier with automated approval processing. Plus, notifications and deadlines can help make sure that everything moves along the approval process in a timely manner.

You can even use these same workflows and notifications to help your team catch duplicate invoices, capture e-mailed invoices automatically, or to take advantage of invoices with early payment discounts so you don’t miss out on an opportunity to save even more money!

How does Ademero measure up?

Built into Content Central is a powerful approval processing engine that lets you manage the stages of a document’s lifecycle by automatically moving them along workflow paths you define.

Automatically notify approval process members of an impending deadline, approve or reject documents with a simple click via your browser, or even approve an expense on-the-go from the mobile app to keep your office and documents moving.

2. Three-Way Matching

Much of the time it’s important to package related documents together before payment can be processed via a three-way match. This match usually includes 3 types of documents: a purchase order, receiving report or packing slip, and a vendor invoice. Only when all documents are present and the details of these documents match can the vendor’s invoice be scheduled for payment.

Three-Way Matching usually involves comparing the following info:

The description, quantity, cost and terms on the company’s purchase order.

The description and quantity of goods shown on the receiving report or packing slip.

The description, quantity, cost, terms, and math on the vendor invoice.

Software can automate this matching process and provide alerts that notify users of missing documents, duplicate invoices, and impending deadlines to make sure that all invoices are attended to in a timely manner.

Even without a workflow in place, three-way matching allows users to easily search for a PO number, a time frame, or a check number and pull back all the related documents quickly and easily.

How does Ademero measure up?

When you pair Content Central’s powerful workflow engine with ‘Packets’ you get the most reliable method of 3-way matching available today.

Content Central’s matching process provides alerts every step of the way for things like missing documents, duplicate invoices, impending deadlines, and more. Then, search related documents with a single check number, PO number, or even a time frame to quickly and easily find the documents you’re needing right now.

3. GL Coding

The General Ledger (GL) is the backbone of any organization’s accounting system used to compile two key financial statements: Balance Sheets and Income Statements. The GL contains user-defined account codes and the listing of the account names, called the chart of accounts (or COA). The process of properly classifying a transaction is referred to as GL Coding and as a manual process requires a lot of time to get right.

Software takes the guesswork out of this process meaning no more manual coding errors or running around the office to get the right personnel involved to code new invoices. Basic software solutions provide a field where GL Codes can be manually entered or selected from a drop down list. While more advanced solutions can automatically populate GL Codes based on vendor, invoice category, or by customized means. They can also use a static GL Code, or require the GL code be completed on approval, and then auto populate amounts against the GL Codes.

In the basic walk-through above, all the paperwork is captured electronically and automatically routed where it needs to go next via workflows. At any step of the way arrival and deadline notifications can be sent to appropriate users, documents can be assigned for review, and information can be passed to other software applications as needed.

How does Ademero measure up?

Content Central allows users to choose what best fits their needs for the coding process. Whether you prefer a manual or automatic one – we take the guesswork out of coding with options like open fields, dropdown selections, automatic population with index data from CapturePoint, static codes, or code entry via approval process.

Pair all this with Content Central’s accounting software integration and you get the most amazing software your accounting department has ever used! With Content Central and QuickBooks accounting software, we take the guesswork out of data-entry and GL Coding.

Accounting Software Integration

The final piece to the puzzle makes the whole process perfect by integrating these software solutions with your current accounting software or ERP. All the data that’s been captured, indexed, and approved can now be passed to whatever accounting software you’re using so you don’t have to enter it all in again!

Even better, with recursive lookups you can check your ERP or accounting system, (like QuickBooks, Sage, and Workday), for updated info that can be applied to documents stored in your DMS. Let’s look at couple scenarios to better understand how everything ties together:

Example 1.) We want to automatically match up these checks that were just cut with their proper invoices

Using Recursive Lookups, invoices that do not have a check number value are scheduled to automatically compare against your accounting software once a day to check to see if the application has issued a check number to apply to the invoice. When a check number exists, the number is input into the check number field for the corresponding invoice in the DMS. Now, when you go back to your DMS to look at a check you can see every invoice that was paid by that check. Simple.

Example 2.) We want to be able to easily see the status of paid and not paid invoices

Once a day all invoices with a status field of ‘NOT PAID’ perform a lookup against the accounting software to check to see if it has been paid. If the invoice has been paid then the status field is updated to ‘PAID’.

Now, managers and CFO’s can not only search what’s been paid, (even between date ranges), but they can also generate reports to include assignees, what stage these invoices are in, and view metrics that can help find bottle-necks.

How does Ademero measure up?

Ademero Software Solutions integrate with many software packages, from accounting software like QuickBooks and other ERPs to Microsoft Office. Information is shared with these other applications to make tasks like data entry a thing of the past.

Keeping it Simple

The hardest part of going paperless for any company is picking the right software. But it doesn’t have to be. Ultimately, you’re looking to accomplish a few things specific to your accounts payable needs:

Automate Data Collection & Entry

Eliminate Redundancies

Streamline Approval Processes

Automate Office Workflows

Centralize and Package Related Documents

Integrate with Existing Accounting Software

Enforce Company and SOX Compliance

Cut Costs and Eliminate Delays

When it comes to picking Document Capture or Scanning Software, it’s best to focus on the purpose of this software to better weed through all the different solutions available on the market today.

There are a number of bells and whistles you’ll be exposed to, but as long as these two requirements are met, you’ll be getting what’s right for your team and for your company:

Automatic Document Type Recognition

Automatic Data Extraction

Document Management Software can be a great addition for your entire company. However, if you’re focused on just your AP department’s needs, you’ll be looking for features like:

Automated Workflows & Approval Processing

Automatic GL Coding

Deadline Notifications

Three-Way Matching

Recursive Lookups

Reporting

Integration with 3rd Party Systems

When it’s all said and done, you’ll be looking for much more than just a new paperless software application. You’re looking for a robust and simple software solution that meet your accounts payable needs at one low price. One that’s fast to implement, smart, and packed with all the features your AP team needs.

CapturePoint and Content Central work together with your accounting software to provide the complete solution for your accounting needs; packed full of powerful features designed to keep your office moving. But don’t just take our word for it, give it a try for yourself and see your customized solution in action.